There has been a lot going on in the watch industry lately, and one name that keeps popping up in the headlines is “Rolex”. This stellar luxury watch brand has been a constant in the watch news because of its prestige, power and various innovative features. However, collectors and enthusiasts have recently looked at the brand’s investment range.

Due to its esteemed status, Rolex has a lot of popularity and demand, which would have made it a great investment option. Investing in a popular replica Rolex model can fetch a high value when selling Rolex on the secondary market.

However, many people are sceptical about all of this suddenly happening. And frankly, so were we. Is it all a bubble just waiting for the right time to burst? Or is there something beyond simple visuals?

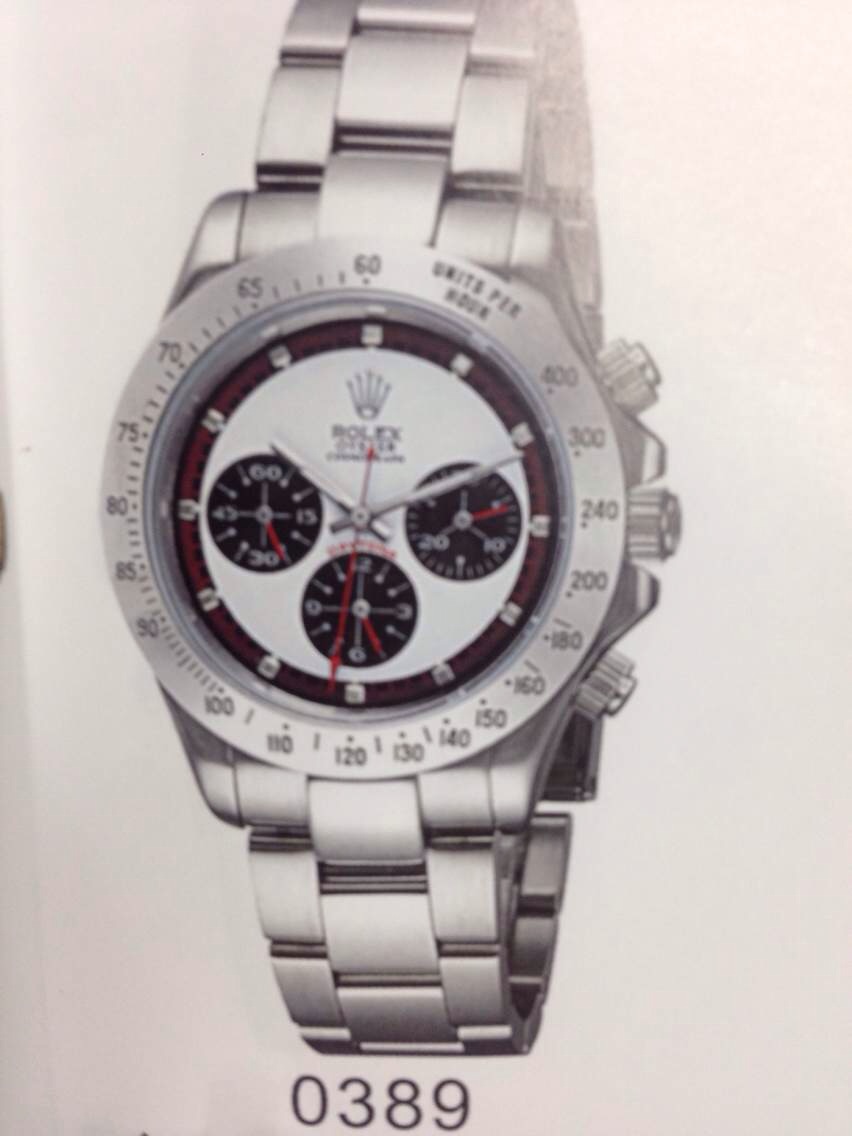

So is the demand for popular Rolex models like the Submariner, GMT-Master II, Oyster Perpetual or Daytona a bubble at risk of collapse?

Confidence, in anything, is a good thing. But your confidence will undoubtedly be tested when you pile up all your savings and go to a seller to buy a Rolex model as an investment. Even for the wildly optimistic, a straightforward “NO” or a fumbling “YES” is enough to shake the foundations of confidence.

Rolex is a brand that has always enjoyed success in the forum. But various factors, such as demand and supply constraints, have led to a catch-22. There is a strange mania for steel Rolex watches, creating all the hype around the popular model .

However, if inflation increases or stays high in your chosen

Not to disappoint you, but chances are all the frenzy surrounding fake Rolex watches will end. As everyone is frustrated with their experience, it will soon check the inflated second-hand market prices. But this does not mean those who invest in luxury watches will incur losses.

Rolex prices will never drop beyond a specific limit. It means that no matter what happens in the next few months or years, you will always get a good value when you sell your Rolex watch. Maybe you won’t get the vast number you expected, but a decent value.

Throughout this writing, we have referred to the abnormal surge in copy Rolex prices and demand as a “bubble”. However, if you look into it, it’s all a result of increased demand and insufficient supply. If the manufacturer had produced enough timepieces to meet the existing demand, you might have had a completely different situation.

Are Rolex prices and the surge in demand a bubble?